Unearned Optimism (Continued)

Posted: March 10, 2012 Filed under: 2012 Election, Economics, Employment, People, Politics Leave a commentAccording to the BLS, employers added 227,000 jobs in February. This was slightly above market expectations, and was slightly higher than the ADP number released on Wednesday. Both December and January were revised upwards, to 223,000 and 284,000, respectively. There’s lots of interesting information in the jobs report that’s not fully captured by the headline numbers, so let’s dive in.

First thing’s first: Was it a good jobs report? It was . . . OKAY. I suspect we have gotten used to really piss-poor numbers and false-starts (a product of the worst recession since the 1930s). Brad DeLong pretty much summarizes the entire jobs report in the subject line of his blog post: “IN A NORMAL RECOVERY, THIS WOULD BE A DISAPPOINTING PAYROLL REPORT. BUT IN THIS RECOVERY THIS IS VERY NICE TO SEE.”

The Bad News:

There are still 12.8 million unemployed persons, and 8.1 million workers who are part-time for economic reasons. There are 1 million discouraged workers not currently in the labor force. Add these numbers together and consider what 227,000 jobs in a month actually means. We have to do more.

The OK News:

The prime-age employment-population ratio (chart above), after several months of increase, did not change from January to February. The headline unemployment rate did not fall or rise. More on that below.

The Good News:

1. Job growth has been consistently over 200,000 since December.

2. Something to note is that even if the headline unemployment rate does not fall, we could still have a good month. The unemployment rate is just one measure of the health of the labor market, but lowering the rate is not a goal unto itself. As the labor market recovers, people who had exited the labor force due to the dearth of jobs will likely start looking for work again, thus putting upward pressure on the unemployment rate even as the number of jobs created puts downward pressure. In this sense, having job creation but an unemployment rate that’s not falling could actually be a good thing at this point in the recovery, as it signals people feel confident enough to start looking for work again. The labor force participation rate increased slightly this month. Ezra Klein has more on this.

To bring this point home, if we consider the broadest of unemployment rates (commonly called the U6 rate), which includes workers who are part-time for economic reasons as well as those who are marginally attached to the labor forced (discouraged workers), we have a rate that is falling very quickly. The following chart plots the headline unemployment rate (right axis, red line) and the U-6 rate (left axis, blue line):

All in all, this was a decent jobs report, and the last three months taken together have been good. But it’s not enough, and it’s not yet clear to me that it is fully self-sustaining. This will be a difficult year with Europe now in a “mild” recession, China growing at a slower rate, and oil prices at very high levels. I would need to see two to three more months of solid employment numbers before feeling “good” about the recovery. Rather than simply hoping things get better, the federal government could be doing much to improve the situation. Congress could act now. But it doesn’t look like that will happen this year.

Unearned Optimism (Jobs Report Countdown)

Posted: March 8, 2012 Filed under: 2012 Election, Economics, Employment, Politics Leave a commentSince January’s positive jobs report, it seems like the tenor of the economic debate has shifted slightly. Obama’s approval rating has risen and people are suddenly talking as if the recovery is again self-sustaining. In other words, the recovery is now being taken for granted. Greg Mankiw, using Intrade, noted that Obama’s chances of being reelected rose by 2 percentage points after the numbers were released. I thought it would be worth going over the reasons people are optimistic and why they might want to temper their expectations. The BLS will release February’s employment report this Friday, and it will also contain revisions to data from January and December. This will help further clarify the present economic situation.

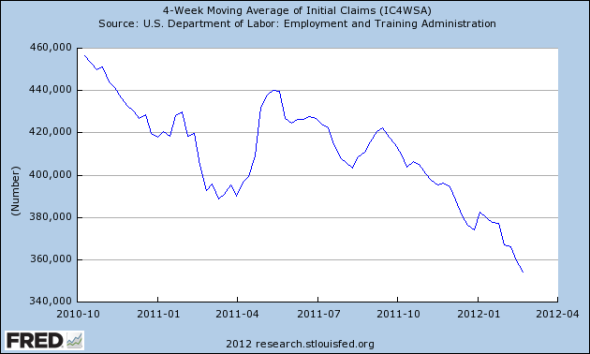

1. Initial Claims

The 4-Week moving average of the seasonally adjusted initial claims data has drifted downward on a fairly consistent basis. However, there are some reasons to be cautious in interpreting this trend. First, there was a similar downward trend in the first quarter of last year before it came to an abrupt end in April/May (think Japan, oil prices, near-government shutdown). See the chart below. Oil prices have again risen this year, and it’s not clear what will happen with Europe, which is already in a recession (we will be lucky if that’s all it is). Second, the seasonal adjustment process may be cause for concern. FT Alphaville has a good set of charts and an explanation of the seasonal adjustment issues (via Nomura).

2. Jobs

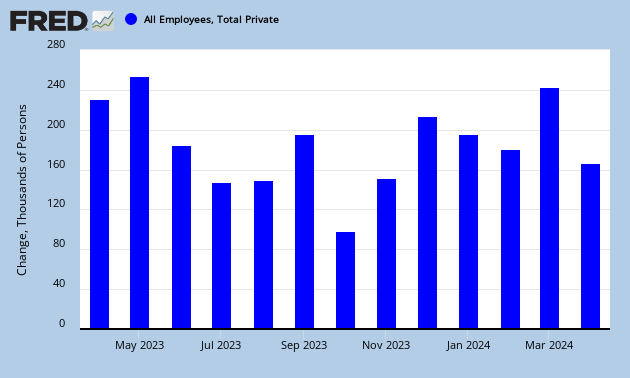

The news was good in January, with about 257,000 private sector jobs added, with robust growth in most industries, including manufacturing. We seem to have a consistent positive trend, but several of these recent data points are still subject to revision. Moreover, this has been a particularly warm winter in the United States, and there are doubts about the seasonal adjustment process as in the case of initial claims. Again, we had a similarly positive trend in early 2011. It’s important to see several months of robust employment reports before declaring victory. ADP, a private firm, released their estimates for private jobs added in February, and it looked robust, though it is not necessarily a great predictor of the BLS data in any given month, though they do trend together. Below is a comparison of the two series, as well as a look at how things were also looking good in early 2011.

3. Housing

I’m not sure there’s been any real progress on this front. I’ve heard that house prices are nearing a bottom, but again, I think it’s still premature to make that argument. Furthermore the different regions in the country are fairly diverse, and certain areas like Atlanta show no signs of a bottom yet. There was a large settlement between state attorney generals and several of the largest banks, and it’s possible some of this money could make a dent for some households. But compared to the scale of the problem, I’m fairly skeptical. More promising (h/t Calculated Risk) is encouraging news that homeowners who are underwater may get a chance to refinance. On the other hand, consumption has been flat for several months.

4. Oil/Motor Vehicle Sales

Oil prices have again risen considerably, getting ever closer to last year’s peak. Meanwhile, and somewhat surprisingly, auto sales have jumped in January and February to very high levels. This is very positive news and shows that maybe high oil prices are not quite as restrictive towards growth as they were last year. James Hamilton has some very clear thoughts on this subject.

We now wait impatiently for Friday’s job report. . .I will try and post my reaction on Friday.