A few nice reads

Posted: February 25, 2012 Filed under: Economics, Education, Finance, People | Tags: black, freddie mac, high school, new york times, stuyvesant Leave a commentA great story in the NYTimes about what it is like to be one of the few in a top-notch high school: “To Be Black at Stuyvesant High” by Fernanda Santos.

Freddie Mac Bets Against Homeowners, from Jesse Eisinger and Chris Arnold.

A very thoughtful piece on Jeremy Lin’s significance, by Jay Caspian Kang

EU Now in the State Building Business

Posted: February 25, 2012 Filed under: Economics, Finance, Politics | Tags: austerity, deflation, greece 1 CommentFrom the FT, an interesting look into what the European Creditor Countries are getting in exchange for their bailout of Greece:

European creditor countries are demanding 38 specific changes in Greek tax, spending and wage policies by the end of this month and have laid out extra reforms that amount to micromanaging the country’s government for two years, according to documents obtained by the Financial Times.

…

“The programme is much, much more ambitious than economic reform,” said Mujtaba Rahman, Europe analyst at the Eurasia Group risk consultancy. “This is state building, as typically understood in traditional low-income contexts.”

Just a brief thought or two. First, it’s clear that austerity in Greece has produced something like a depression there. IMF’s World Economic Outlook shows that output (estimated) dropped 5 percent in 2011, and is expected to drop another 2 percent in 2012. The unemployment rate is around 16-17% for 2011, and they project it to stay above 17% through 2016, the last year of their most recent projections. Maybe there was no choice but to cut spending since they could not borrow. But that doesn’t mean it hasn’t made the situation much worse.

Second, the problems in Greece are debt overhang in the (i) private and (ii) public sectors, (iii) a shortfall in demand as incomes and employment have both fallen sharply, (iv) and a lack of competitiveness vis a vis the rest of the world. The current prescription seems to try to tackle (ii) by slashing government spending and implementing various structural reform programs. In the process, they seem to be trying to tackle (iv) not by having higher inflation in countries like Germany so that Greece’s products seem more attractive, but instead by opening up professions and slow, painful wage deflation. But the austerity and wage deflation have made (iii) much, much worse. Structural reforms seem nice over the long run, but if there’s no money to buy goods and services, and prices are falling by a few percentage points a year, then it’s hard to picture how Greece will return to a point of normalcy. I don’t mean to say that there’s a magical solution that tackles (i), (ii), (iii), and (iv) simultaneously with no cost whatsoever, but it seems like the burden that is being placed on the Greek people may be too much for them to carry.

The New York Times has a piece on “How Greeks Live Now”:

By many indicators, Greece is devolving into something unprecedented in modern Western experience. A quarter of all Greek companies have gone out of business since 2009, and half of all small businesses in the country say they are unable to meet payroll. The suicide rate increased by 40 percent in the first half of 2011. A barter economy has sprung up, as people try to work around a broken financial system. Nearly half the population under 25 is unemployed.

Ezra Klein on Elite Graduates in Finance

Posted: February 21, 2012 Filed under: Economics, Finance, People | Tags: ezra klein, finance, harvard, mit, princeton, STEM, yale Leave a commentEzra Klein recently wrote a column on Bloomberg looking at the large numbers of students at elite schools who end up in finance and finance-related fields. Some of the points resemble what I wrote in a post back in August.

It gives me some joy to note the similarity between our thinking. In August, I wrote:

How many people enroll in Harvard University and dream of working for a hedge fund or investment bank? And in an ideal world, what should that number be? It’s certainly greater than zero, but one would think (and hope) that it ought to be pretty close to zero

Ezra writes:

No high school senior gets her acceptance letter from Harvard and begins thinking about the exciting life she will lead constructing credit derivatives. But that’s where many students end up.

He emphasizes the fact that liberal arts schools, including the most prestigious ones like Harvard, Yale and Princeton, are failing their students in teaching them skills that they need. His explanation is two parts.

First:

It begins by mimicking the application process Harvard students have already grown comfortable with. ‘It’s doing a process that you’ve done a billion times before,’ explains Dylan Matthews, a Harvard senior. ‘Everyone who goes to Harvard went hard on the college application process. Applying to Wall Street is much closer to that than applying anywhere else is.’

I can attest to observing this kind of behavior and being victim to it myself. People spend their lives in school, learning to apply to the most prestigious and reputable brands. They get there, and then they wonder what to do next. Consulting, finance, and programs like Teach for America, as Ezra Klein notes, provide this next level for young adults.

The second part is perhaps the bigger part of the explanation:

Wall Street is promising to give graduates the skills their university education didn’t [. . .] Wall Street is filling a need that our educational system should be filling.

I think there’s something to what Ezra Klein says, and I think his points about the liberal arts education are largely true in today’s economy. Colleges, even the most elite ones, are basically failing to teach proper skills to students, and failing to convey the reality of life after college in any meaningful way. College should not be seen or used as an escape from the real world, though that’s how they often feel. Liberal arts colleges should instead serve as a place to study the real world and transition into it. This is a vague prescription for change, I know. Still, there’s something to this explanation.

However, I think Ezra Klein stumbles on a few points.

First, on Teach for America, which Ezra uses to illustrate the notion that prestige and a promise to teach skills are what matter for elite students. While I don’t have raw numbers, I can say that significant numbers of those who go into Teach for America tend to use it as a stepping stone into other fields, often finance and consulting-related. At the very least, we can say that many do not stay in teaching. Teach for America looks great on a resume, and as Ezra says, it teaches skills that college does not. Many take part in the program before medical school, law school, or going into a prestigious investment house. I do not mean this as a critique of Teach for America, nor do I mean it as a critique of those who leave. Even for those people that leave for finance or consulting, they still did incredible work and showed remarkable commitment to the youth by choosing to teach, if only for a few years. It’s more than could ever be said for me.

I only bring this up to again reiterate the fact that even those that go into Teach for America often end up in other fields, and often it’s finance. These are smart people who could either stay in teaching or go into a large number of other lucrative fields, and they often decide to leave. Maybe some of it is because they are genuinely interested in different fields. But some of it has to do with compensation. I think this is further evidence that the financial incentives offered by Wall Street and the financial disincentives of fields like teaching cannot be ignored in this kind of analysis.

I have a second point that might further drive this point home, and that is that it’s not just elite students at liberal arts schools that are being sucked into Wall Street. If you’ve paid attention over the past decade, one of the most disconcerting trends is the large number of STEM (science, technology, engineering and math) graduates who end up in these fields. The education for these individuals is decidedly more focused and pre-professional in some sense. There is a direct need for an electrical engineering graduate, for instance, versus a political science major, and we could say that the former probably has a better idea of where his skills are leading him.

And yet the evidence also points to large swaths of these people also being lured into Wall Street. A few data points: a full 27.2% of MIT’s working undergraduate class of 2008 went into Finance, and an additional 12.9% went into consulting. The University of Pennsylvania’s Engineering School’s working class of 2008 sent a full 33% towards financial services, and an additional 22% into consulting. I don’t believe we can say these schools are also failing their students, at least not to an extent that would explain these kinds of numbers. These are in-demand skills and degrees, and yet an overwhelming number of these students are going into finance. Ezra’s hypothesis no longer seems to hold true when we start looking at these individuals.

We cannot have a discussion about finance’s disproportionate role in this economy without acknowledging that financial incentives matter. Ezra Klein makes important points about problems with liberal arts’ failures, and I applaud him for pointing them out in his column which has a wide audience. We should take them to heart, but we cannot hope to fix finance’s allure through this lens alone. In the end, money talks.

Failed Policies and Depression Economics

Posted: February 5, 2012 Filed under: Economics, Politics | Tags: cowen, depression, keynes, koo, krugman, leonhardt, recession, stimulus Leave a commentIn the September 7th Republican Presidential Debate, Rick Perry said, “Keynesian policy and Keynesian theory is now done.” It was a curious remark, revealing the strange bubble American politicians often live in. The implication wasn’t just that the stimulus package from early 2009 hadn’t worked, but that it had actually made matters worse. And today, we hear similar opinions being expressed by people who should know better (see Paul Krugman on Tyler Cowen).

There are now plenty of examples which show how austerity has not worked, and how Keynesian policies, when tried, actually have worked. Keynesians do not say that without stimulative spending, the economy will never grow again. What they do say is that there will be an unnecessarily long period of high unemployment and general suffering that could be diminished with increased government spending. Quoting Krugman : “We said that as long as the economy remained deeply depressed, even a huge rise in the monetary base would not be inflationary, and that even huge budget deficits would not send interest rates soaring. And we said that fiscal austerity would be contractionary, not expansionary.” All of this has been true.

Examining government policies and the resulting outcomes is never easy in terms of identifying cause and effect. But one of the reasons worldwide downturns are illuminating for economics is that we can view how different countries with different institutions and fiscal policies had different outcomes.

I will go through some of them.

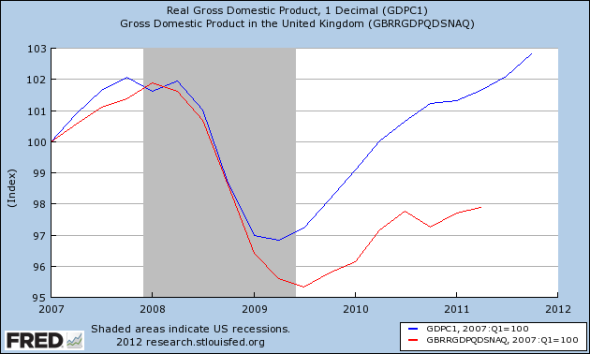

1.) When David Cameron formed his government in the United Kingdom in 2010, the immediate plan was for ‘expansionary austerity’, a term that is every bit as senseless as it sounds. The idea was that the government had to credibly cut spending immediately to produce two results: first, to prevent the bond markets from fleeing UK debt and sending the cost of borrowing to very high levels that would edge the country towards default; second, to actually spur economic growth by increasing “confidence.” The first reason shows a profound misreading of events. Those in the Conservative party looked to the Euro Zone, saw countries like Greece and Ireland, and thought that to calm bond markets in the near future, they had to practice austerity. They had little understanding of the fact that the shared currency was a key reason Ireland and Greece were in such dire straits, and that austerity had only made matters worse in those counties. Paul de Grauwe has been most articulate in explaining this.

The second reason, that “confidence” will somehow be the savior in the face of massive spending cuts, has been the most intellectually lazy belief. This is the “confidence fairy” that Paul Krugman often refers to. How exactly will private sector confidence be boosted, and what would that entail? Well, since government spending is lower . . . .the private sector will feel more compelled to come in and fill in the gaps, since public debt will be on a more sustainable path. Huh? I don’t actually understand the argument myself.

The result of these disastrous policies is that the United Kingdom, if we are to look at output, has faced it’s worst recession . . . ever. That includes the Great Depression. See the blue line in the following chart, courtesy of http://www.niesr.ac.uk/:

2.) Ireland, which has suffered so much in the last 5 years, has cut spending massively in the face of a miserable economic environment and huge debt overhang. One may argue that Ireland, in being apart of the Euro Zone, simply had no choice but to cut spending since bond markets were not allowing them to borrow. This may be the case. But the evidence shows that bond markets are still not willing to lend to Ireland. The ECB/IMF/EU’s solution then, rather than to lend freely to Ireland, was to slash spending. Some people, like Tyler Cowen, were seemingly willing to call Ireland a success story in the middle of 2011, due to small upward movement in GDP. How you can call this an example of why austerity can work is beyond comprehension. Furthermore, it was just that, a blip. See the the most recent GDP report: http://www.cso.ie/en/media/csoie/releasespublications/documents/latestheadlinefigures/qna_q32011.pdf

3.) Latvia, where the unemployment rate reached 20.5 at one point. I will leave this to the CEPR: http://www.cepr.net/index.php/publications/reports/latvias-internal-devaluation-a-success-story

4.) In the United States, the recession ended in the middle of 2009, as the ARRA had gone into full swing, and the country began growing again even as the private sector was weak. By the end of 2010, the economy was again adding jobs, and has been on a consistent basis. The basic idea is that as the private sector delevers and pays down debts, if the government does not correspondingly increase spending, the overall economy will lose more jobs and grow more slowly than it otherwise would have. The federal government was thus filling in the hole left by the private sector. State and local governments were, in contrast, cutting spending. This is why the stimulus as passed was not as big as it should have been. Net government spending increased for a time, but not nearly enough to match the severity of the economic climate. Richard Koo’s work has focused on this. See David Leonhardt for a concise view of the facts.

Since 2011 when stimulus money had essentially been exhausted, government has been a net drag on the economy as state and local governments have slashed spending and employment. Employment reports since 2011 have generally been very weak (where beating expectations only meant that expectations were very low), and GDP growth was also very weak throughout 2011. The logical explanation is that government austerity (at the state/local level if not at the federal level) led to weak growth in both output and employment since balance sheets of households were still very weak. Some government policies like extending unemployment insurance benefits and payroll tax cuts helped mitigate some of these effects.

January’s Employment Report has been the first genuinely good employment report of the recovery, showing significant private payroll additions in a broad swath of industries and a meaningful uptick in the prime-age employment-population ratio (I prefer this to the unemployment rate). One good month does not yet make a trend, though I certainly hope it is. The CBO and others, however, forecast a rise in the unemployment rate by the end of the year.

Regardless, I do not see how this means that Keynesian doesn’t work. Looking at the key insights: Interest rates for 10-Year Treasuries are hovering around 1.8 percent in the face of large deficits, the economy grew very slowly last year in the face of deep state and local government cuts. If the private sector has completed repairing their balance sheets, then the economy should be expected to grow even if government spending fades. But I think this is still wishful thinking at this point. If federal payroll tax cuts and extended unemployment insurance benefits are not extended, and if all of the Bush tax cuts expire in January, we may see employment reports revert to being very mediocre, as they did last year. Furthermore, Europe’s problems still loom very large. All of this makes the case for increased federal spending in 2012, and vindicates Keynesian policies. I would prefer that we learn from the failed examples of austerity rather than go through it ourselves only to see how much worse off we are. It is a mystery how some like Tyler Cowen see the first genuinely good employment report 2.5 years after the recession officially ended as a sign that Keynesian economics is discredited.

The main threat to our current recovery is learning the wrong lessons.